Continental Resources said new wells have been identified to reload CLR’s E&P program to allow the company to drill comfortably for 20 years at 100% rates of return, assuming $65 WTI.

As a result, the recent pullback in shares is providing investors with a chance to finally grab this best of breed company at a decent value.

Financial Update

“Continental’s strong third quarter and early fourth quarter results reflect our strategic decision to focus operations on oil-weighted production growth,” said John Hart, Chief Financial Officer. “Continental is poised to deliver a strong exit rate, increase our oil production growth and continue to use significant free cash flow to further reduce debt toward our long-term target of $5 billion or below.”

As of September 30, 2018, the Company’s balance sheet included approximately $13 million in cash and cash equivalents and $5.96 billion in total debt. On September 30, 2018, net debt (non-GAAP) was $5.94 billion. Net debt is projected to be between $5.4 and $5.6 billion at year end 2018, driven by strong cash flow. The Company’s third quarter annualized net-debt-to-EBITDAX ratio was 1.49x and has now reached levels seen prior to the three-year commodity down cycle.

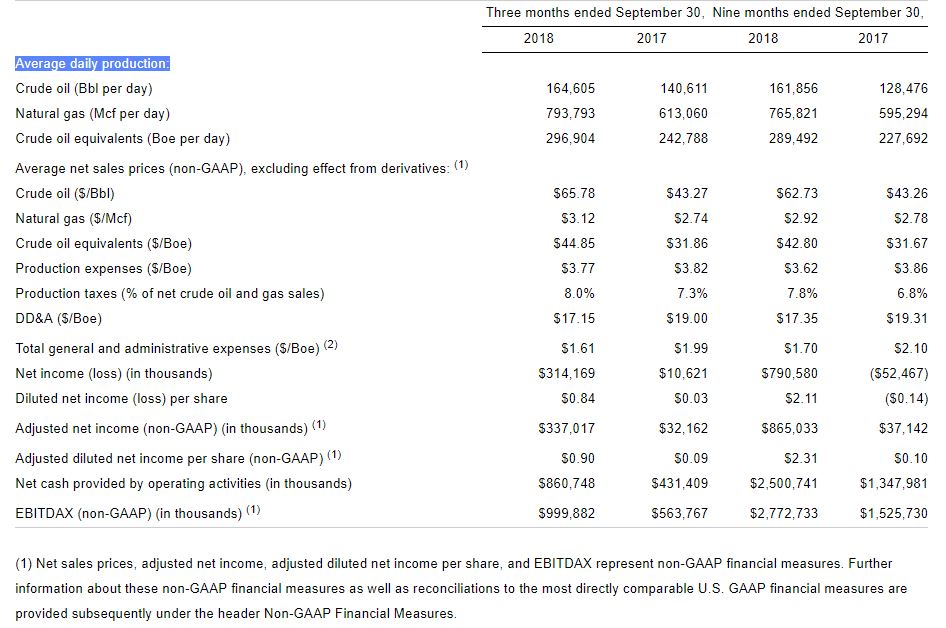

In third quarter 2018, the Company’s average net sales price excluding the effects of derivative positions was $65.78 per barrel of oil and $3.12 per Mcf of gas, or $44.85 per Boe. The Company remains unhedged on oil. Production expense per Boe was $3.77 for third quarter 2018.

Non-acquisition capital expenditures for third quarter 2018 totaled approximately $790.8 million, including $633.5 million in exploration and development drilling, $105.5 million in leasehold, and $51.8 million in workovers, recompletions and other. Non-acquisition capital expenditures for third quarter were slightly higher than projected due to timing of completions that will see first production in fourth quarter 2018 or in 2019.

The following table provides the Company’s production results, per-unit operating costs, results of operations and certain non-GAAP financial measures for the periods presented. Average net sales prices exclude any effect of derivative transactions. Per-unit expenses have been calculated using sales volumes.

Third quarter 2018 production totaled 27.3 million barrels of oil equivalent (Boe), or 296,904 Boe per day, up 22% from third quarter 2017. Total production for third quarter included 164,605 barrels of oil (Bo) per day, as well as 793.8 million cubic feet (MMcf) of natural gas per day. The following table provides the Company’s average daily production by region for the periods presented.

The Company’s Bakken production hit an all-time quarterly record, averaging 167,643 Boe per day in third quarter 2018, up 23% versus third quarter 2017. During the quarter, the Company completed 42 gross (26 net) operated wells flowing at an average initial 24-hour rate of 2,013 Boe per day. Two of the wells ranked as top ten 30-day rate Bakken wells for the Company, including the Wiley 8-25H (2,289 Boe per day) and Mountain Gap 3-10H (2,094 Boe per day). All Company top ten 30-day rate Bakken wells have been completed in the past twelve months.

The Company currently has 8 rigs drilling in the Bakken, up 2 rigs from last quarter to facilitate continued oil growth in 2019. In fourth quarter 2018, production is expected to ramp significantly with up to 70 wells forecasted to be completed by year end 2018.

“The performance and returns from the Bakken have been exceptional,” said Jack Stark, President. “Our entire 2017 Bakken program, which included 133 operated wells, paid out by the end of third quarter 2018. Now that’s capital efficiency.”

One thought on “At $65 WTI Continental Resources Sees 20 Years Of 100% Returns”