EOG Resources, Bill Thomas. Second Quarter and Full Year 2020 Forecast

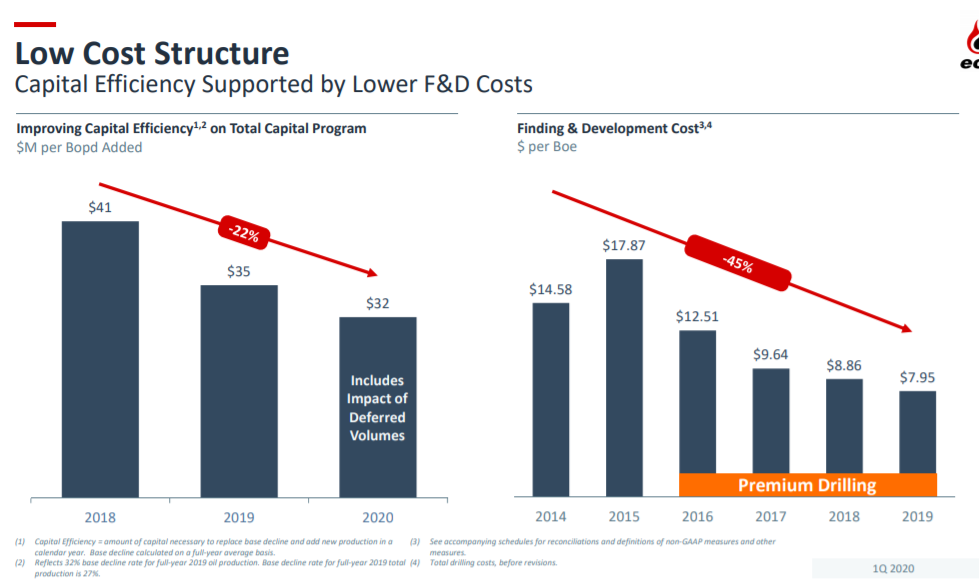

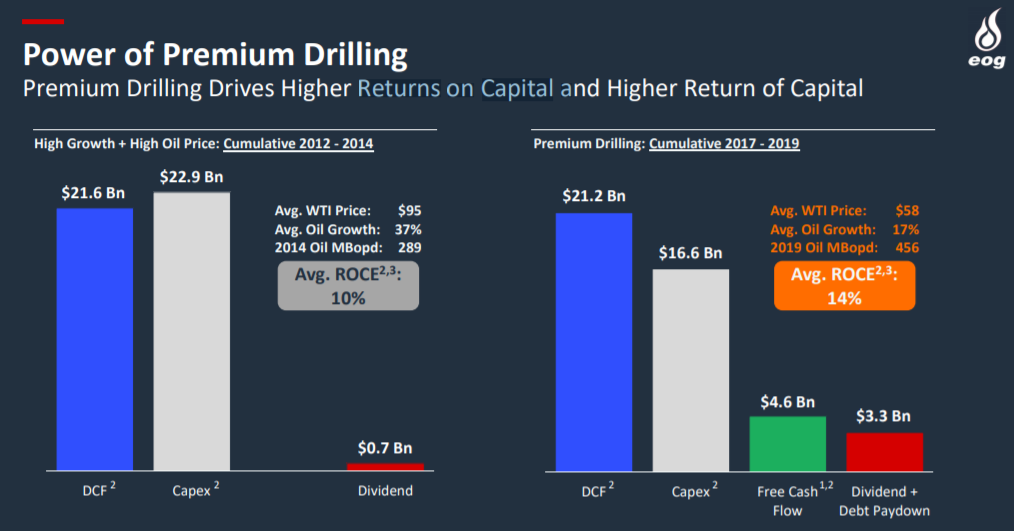

We entered this downturn in a position of operational and financial strength, and the reason for this is our consistent approach to the fundamentals of our business: return-focused capital allocation, supported by a strong balance sheet. Rest assured that EOG’s priorities will remain the same throughout the duration of this crisis. First, only invest capital if it generates premium rates of return. Our disciplined approach to reinvestment does not change. We invest to make a return, even with low oil prices. We will not drill a well if it doesn’t earn at least a 30% direct after-tax rate of return.

Our goal each year is to spend within cash flow and maintain an impeccable balance sheet to support operations and protect our dividend through challenging times. Sixth, continue to strategically invest in the long-term value of our business. Through each of the prior downturns, EOG has emerged a stronger business because we continue to invest in the long-term value of the company. Whether it was leasing exploration acreage in the Eagle Ford to jump-start our transition to oil or the Yates acquisition in 2016. Challenging times for the industry often offer the best opportunities to invest.

EOG has also added additional hedges for 2020. We now have hedged more than 95% of our second-quarter oil production at an average price of $48 and more than 50% of our third quarter production at $47.

EOG has moved quickly to reduce its operating activity. The company lowered its operated rig count from 36 rigs to eight rigs during the last six weeks, with an average of approximately six rigs expected for the remainder of 2020. EOG has identified over 4,500 net drilling locations ‐ more than nine years of inventory at the 2020 activity pace ‐ that is capable of generating

strong rates of return at less than $30 WTI oil. The company plans to focus its 2020 activity on these high‐return wells.