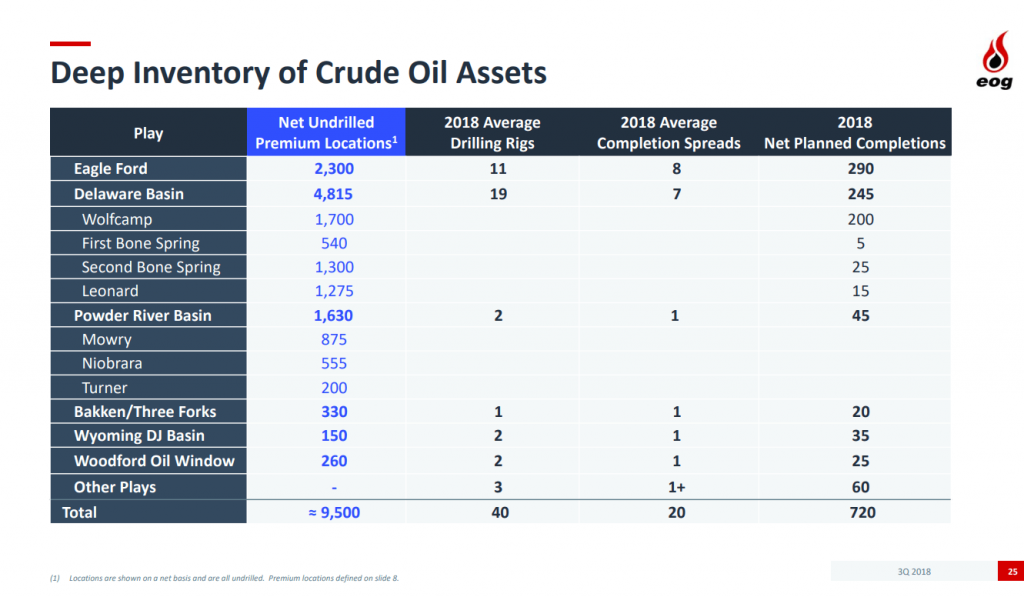

EOG expects to complete 20 additional net wells in 2018 (for a total of 720) compared to its prior forecast, with the increased activity targeted for the Eagle Ford Shale. Meanwhile, 65% of its anticipated 2019 OFS needs already have been secured, which is higher at this point in the calendar year than in past years.

EOG holds a large acreage position across the Rocky Mountain area, which includes land in the North Dakota Bakken, Colorado DJ Basin, and WY Powder River Basin, where it produced 66,000 BPD last year. While the Bakken has long been an important region for EOG, the Powder River Basin is emerging as a very compelling area for the company after it discovered 1.9 billion BOE of additional resources in early 2018, boosting its total in that region to 2.1 billion BOE.

EOG set a company record and exceeded the high end of its target range for crude oil volumes

in the third quarter 2018 by producing 415,000 barrels of oil per day (Bopd), an increase of 27

percent compared to the same prior year period. Natural gas liquids (NGL) production increased

46 percent while natural gas volumes grew 13 percent, contributing to total company

production growth of 25 percent.

Per-unit operating expenses declined during the third quarter 2018 compared to the same prior

year period. General and administrative expenses fell 20 percent, transportation costs declined

15 percent and depreciation, depletion and amortization expenses fell 13 percent, all on a perunit

basis.

EOG generated $2.3 billion of discretionary cash flow in the third quarter 2018. After

considering exploration and development expenditures of $1.7 billion and dividend payments

of $107 million, EOG produced free cash flow during the third quarter of $503 million. Please

refer to the attached tables for the reconciliation of non-GAAP measures to GAAP measures.

“EOG delivered a compelling combination of production growth, high returns and free cash flow

in the third quarter 2018 due to disciplined capital allocation.

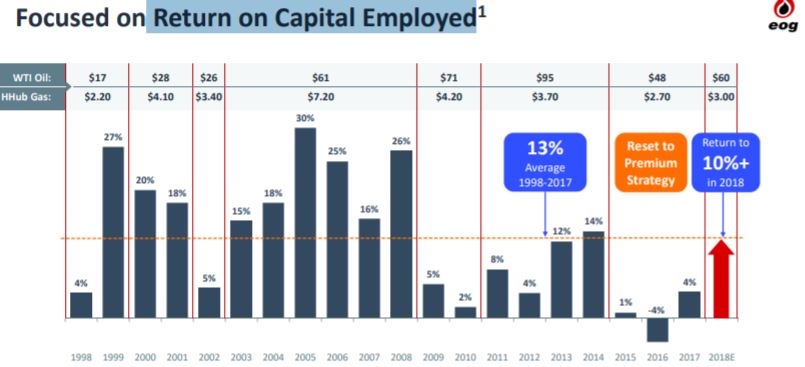

EOG is generating strong returns at current WTI prices.

The company is able to operate at $40 oil with comfortable margins, which makes the company’s operations indifferent to oil price volatility.

EOG is also expanding production in newer basins, which should add to growth prospects for 2019.

The recent pullback in shares is offering investors a good risk-reward entry point to go long.