London-based Vakt launched its digital trading platform early Thursday morning, for now focused on North Sea oil contracts.

Trinidad Drilling Posts a white flag on it’s FB page

You’ve probably heard by now that Ensign has successfully acquired a majority of Trinidad’s shares. It will take some time for us to navigate these…

JPMorgan Chase & Co upgrades Keane Group (NYSE:FRAC) buy target from 18 to 19.00

Keane Group (NYSE:FRAC) had its price target hoisted by JPMorgan Chase & Co. from $18.00 to $19.00 in a research note published on Friday, November…

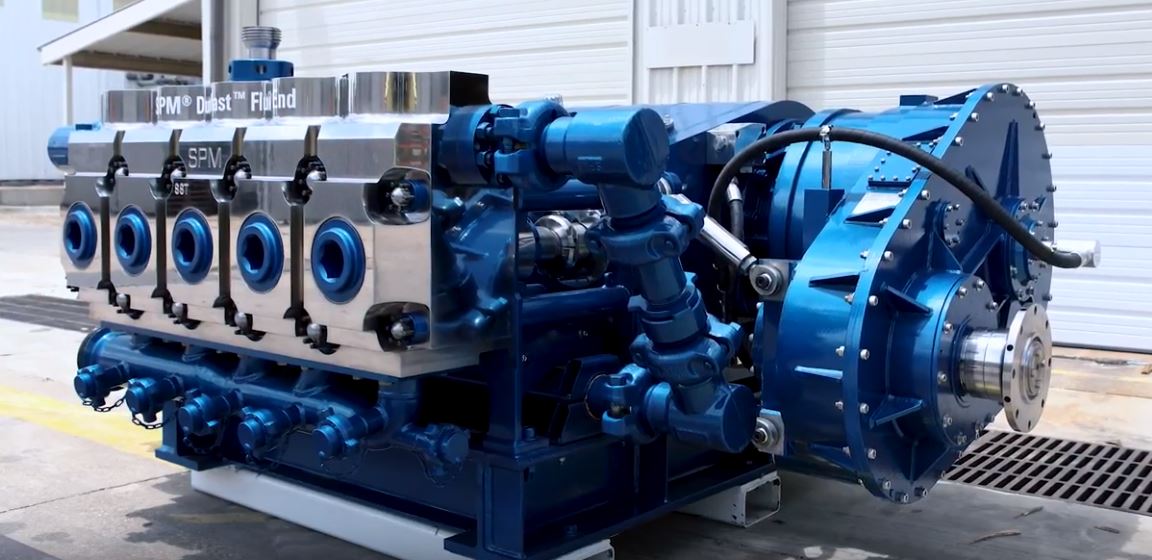

SPM® QEM 3000 Frac Pump continues to yield unsurpassed results

one of the world’s largest suppliers of pressure pumping equipment to the upstream market, today announced its SPM® QEM 3000 Frac Pump continues to yield unsurpassed results and savings in the field as it looks and performs like new after 3,200 hours of field-proven use in extreme conditions in the winter months in the Duvernay and Montney Shale Play in Alberta Canada.

J-Series Driveshafts for hydraulic fracturing pumps?

A leading global manufacturer of pressure pumping equipment for oil and gas applications needed a replacement heavy-duty driveshaft for its 2500 HP diesel-powered frac pump…

Saudi Aramco Plans to Invest $500 Billion over the next 10 years

Saudi Aramco aims to become a global refiner and chemical maker, seeking to profit from parts of the oil industry where demand is growing the fastest while also underpinning the kingdom’s economic diversification.

Pemex adds 1B barrels of oil reserves in biggest onshore find in 25 years

Pemex triples estimate of Veracruz oil field’s reserves.

Pemex’s preliminary development plan includes drilling more than 40 development wells at a cost of more than $1.5 billion, Carlos Trevino, Pemex general director, said at an event Tuesday announcing Ixachi’s progress.

“The expected value of the total production of Ixachi is worth $40 billion,” Trevino said. “Based on these numbers, you can see how profitable this project will be.”

Halliburton (NYSE:HAL) has seen its stock price decline by almost 30% since early October

Halliburton (NYSE:HAL) has seen its stock price decline by almost 30% since early October, currently trading at about $31 per share. While the stock has…

Drilling and completion operations within the Wolfcamp play

Rising productivity in the Wolfcamp, like in other plays in the Permian Basin, has been driven mostly by drilling longer horizontal laterals and optimizing completions, according to EIA. The length of laterals in the Wolfcamp increased from an average of 2,500 linear feet in 2005, to more than 8,500 linear feet in 2018.

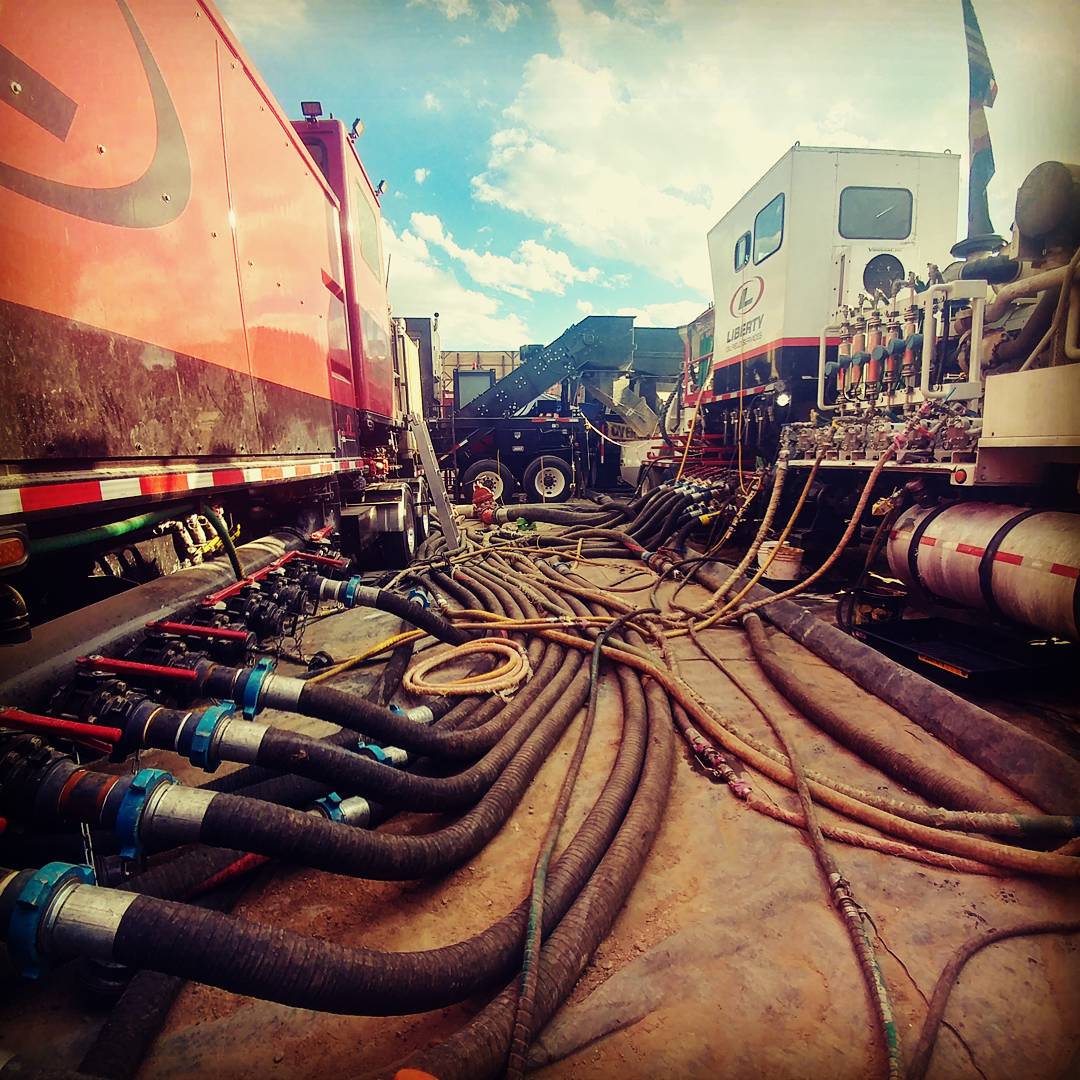

NYSE:LBRT – Liberty Oilfield Services Stock Outlook

Bank of America Corp DE grew its stake in shares of Liberty Oilfield Services

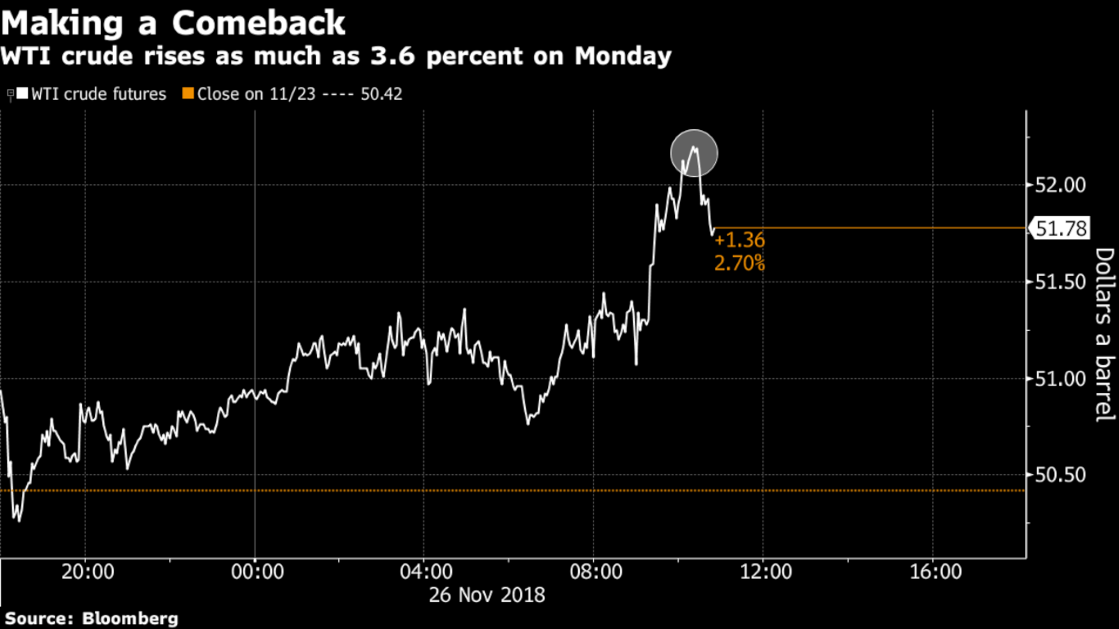

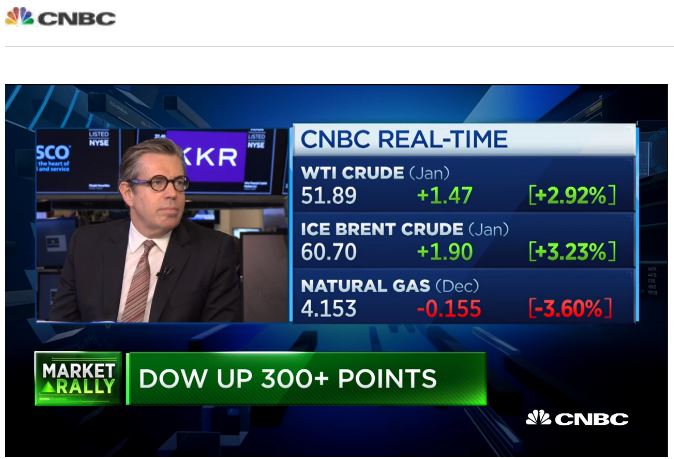

Optimism Over End to Oil Glut

Crude posted its biggest gain in almost two months as the world’s largest oil exporters prepare to discuss global supplies.

Futures rose 2.4 percent in New York on Monday after registering the worst weekly swoon in more than 2 1/2 years. All eyes are on this week’s G20 gathering in Argentina that will include Saudi Crown Prince Mohammed Bin Salman and Russian President Vladimir Putin. That event will be followed by a key OPEC meeting next week in Vienna.

The Mexico City-based company Vista Oil & Gas plans to invest $157.4 million in Argentina’s Vaca Muerta

Vista Oil & Gas plans to invest $157.4 million in its first pilot projects in Vaca Muerta, betting on the Argentinian shale play for oil and natural gas production growth.

$50 oil is bad for the US, Goldman Sachs commodity chief warns

Goldman Sachs contradicts Trump: $50 oil is bad for the US, commodity chief warns

$50 oil is bad for the U.S. because it hurts American drillers and threatens to create problems in the credit market, Goldman Sachs’ Jeff Currie warns.

President Donald Trump has been cheering oil’s plunge into a bear market and urging Saudi Arabia to drive the cost of crude even lower.

Currie thinks Saudi Arabia and Russia will prevail in convincing Trump that price-boosting production cuts are necessary at this week’s G-20 meeting.

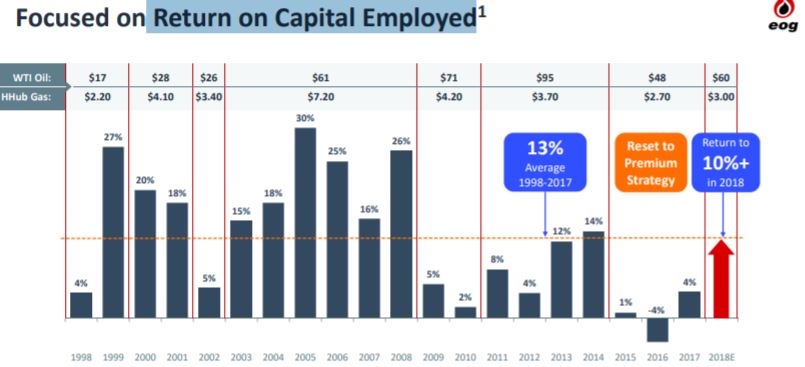

EOG Will Boosts Spending, Oil Production Guidance After Record Quarter

EOG Resources Inc. is increasing its 2018 exploration and development expenditure forecast and raising its target for full-year crude oil production growth after posting record volumes during the third quarter, management said.